Introduction

In international trade, numerous payment instruments facilitate transactions concerning consumers and sellers across borders. Knowing these devices, for instance costs of Trade, promissory notes, and documentary collections, is very important for making certain safe and successful payment procedures. Just about every instrument serves a novel reason and gives distinct levels of protection and adaptability.

Expenses of Trade

Definition and Usage

Definition: A Invoice of exchange is really a composed buy by a single celebration (the drawer) to a different (the drawee) to pay a specified sum of cash to a third party (the payee) with a specified day. It is commonly Employed in Global trade to facilitate payments.

Utilization: Expenditures of Trade tend to be made use of when the client and vendor have an established romantic relationship. The vendor can attract a Invoice on the client, which can be recognized and paid at maturity.

Added benefits: They offer a proper and legally binding instrument for payment, giving protection to each the seller and the client. The seller can discount the Monthly bill that has a financial institution to obtain immediate cash, even though the buyer can system for the payment over the owing date.

Promissory Notes

Definition and Usage

Definition: A promissory note is usually a published promise by just one occasion (the maker) to pay for a specified sum of money to another party (the payee) on the specified day. Contrary to a bill of exchange, It is just a immediate guarantee to pay for rather then an purchase to some third party.

Usage: Promissory notes are Utilized in several financial transactions, like Global trade, to proof a personal debt obligation. They tend to be utilised when the customer needs to formalize a payment dedication.

Gains: Promissory notes offer you an easy and legally enforceable implies of documenting a financial debt. They can be transferred or discounted, offering versatility in financing arrangements.

Documentary Collections

Definition and Utilization

Definition: Documentary collection is often a method in which the exporter (vendor) instructs their bank to gather payment from the importer (consumer) from the presentation of delivery and industrial files. The financial institution functions as an intermediary, facilitating the exchange of files for payment.

Utilization: Documentary collections are utilised in the event the exporter desires to maintain Management about the transport paperwork until finally payment is acquired. They can be well suited for transactions exactly where the potential risk of non-payment is pretty minimal.

Benefits: This method supplies a equilibrium in between protection and value-success. The exporter retains Manage in excess of the paperwork, guaranteeing that the products are usually not released until eventually payment is designed, though the importer Rewards from not needing to pay back beforehand.

Comparison of Payment Instruments

Stability and Chance

Expenditures of Exchange: Give you a medium standard of protection, as they are lawfully binding and might be discounted. However, the chance of non-payment remains Should the drawee defaults.

Promissory Notes: Supply a direct guarantee to pay, decreasing the risk of non-payment in comparison with expenses of Trade. However, they don't supply the identical level of protection as letters of credit history.

Documentary Collections: Present a greater level of safety for that exporter by retaining Handle around the shipping documents. However, they don't provide a payment promise like letters of credit history.

Cost and Complexity

Costs of Exchange and Promissory Notes: Usually entail lower prices and so are less difficult to use in comparison to letters of credit rating. They may be ideal for transactions in which the parties have founded believe in.

Documentary Collections: Include moderate charges and complexity. They're safer than open up account transactions but significantly less so than letters of credit score.

Conclusion

Comprehension the several payment instruments in Intercontinental trade, such as bills of exchange, promissory notes, and documentary collections, is important for corporations to handle risks and assure economical payment procedures. Every instrument gives unique Gains and is appropriate for differing kinds of transactions and danger profiles.

Regularly Asked Thoughts (FAQs)

Exactly what is a Invoice of exchange in Intercontinental trade?

A Invoice of Trade can be a prepared order to pay a specified sum of money, used to aid payments between buyers and sellers in Worldwide trade.

So how exactly does a promissory Notice differ from a Monthly bill of exchange?

A promissory Be aware can be a direct assure to pay for, while a Monthly bill of Trade can be an get to the 3rd party to pay. Promissory notes are less difficult and contain only two functions.

What exactly are some great benefits of utilizing documentary collections?

Documentary collections supply a harmony amongst stability and price-performance, letting the exporter to retain Handle above Trade finance APIs delivery files until payment is produced.

Which payment instrument provides the very best protection?

Letters of credit rating give the very best safety, as they offer a payment assure from the bank. On the other hand, They're also the costliest and complex.

When need to expenses of Trade or promissory notes be utilised?

These devices are suited to transactions exactly where the functions have established have confidence in and the chance of non-payment is fairly small.

Ariana Richards Then & Now!

Ariana Richards Then & Now! Jason J. Richter Then & Now!

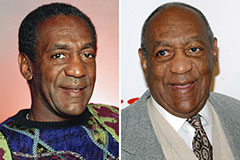

Jason J. Richter Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!